This guide is your roadmap, curated for Guyanese entrepreneurs seeking to understand the ins and outs of registering and establishing a company in the USA from Guyana. Together, we’ll navigate the legal, financial, and operational elements, clearing the path toward your entrepreneurial success.

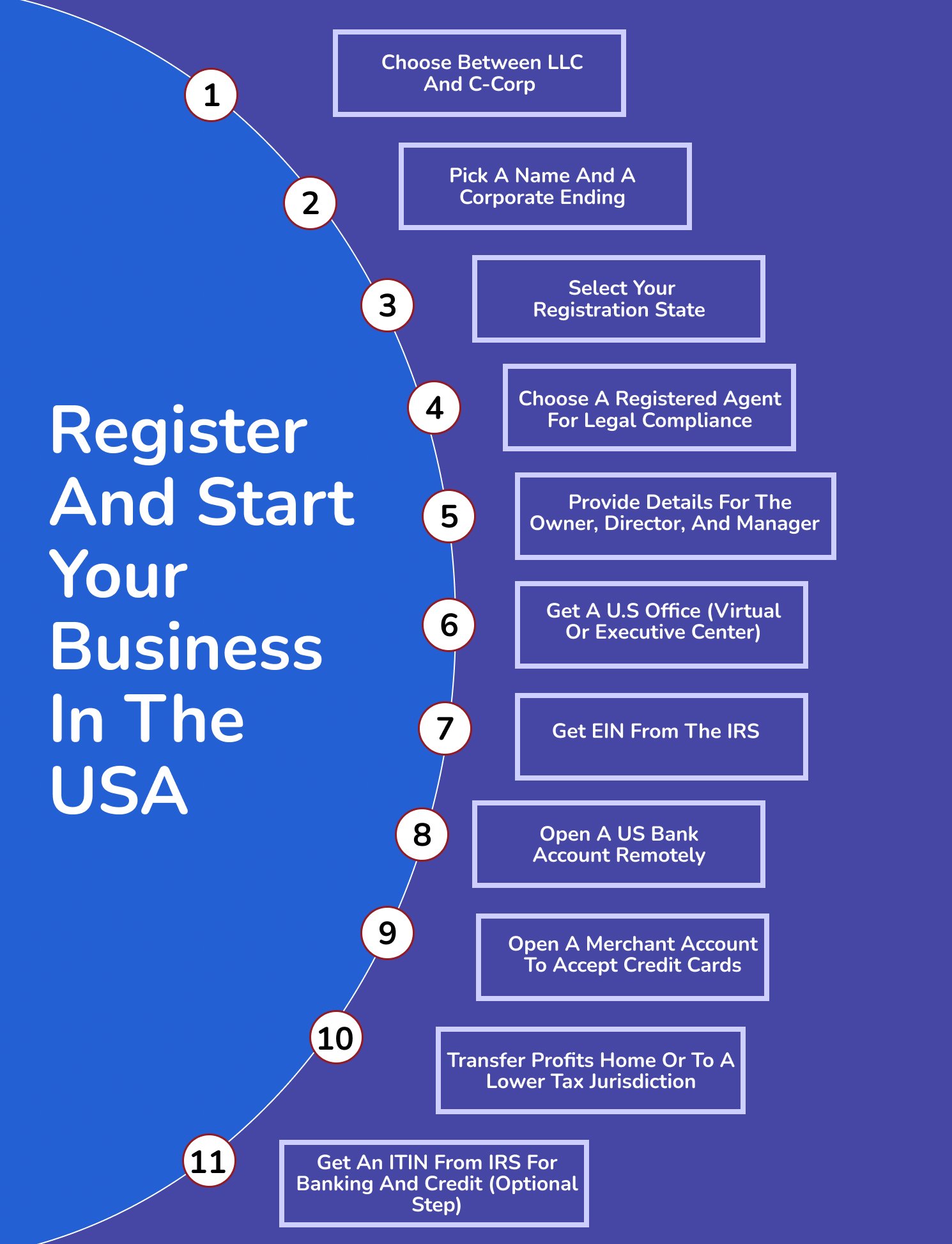

Register and Start your business in the USA

Step 1: Choose between LLC and C-Corp

Register LLC in the USA from Guyana:

2. Ownership: U.S. LLCs impose no restrictions on ownership. Members can be non-U.S. citizens, non-resident aliens, or companies, both domestic and international, offering a flexible structure for entrepreneurs.

3. Management: LLCs in the U.S. offer a malleable management structure, allowing owners to tailor their roles and business operations without stringent formalities. With a design that accommodates both Sole Proprietorships and Partnerships, LLCs provide a simplified yet effective management and ownership model.

4. Compliance: LLCs generally have fewer compliance obligations and formalities, potentially reducing legal and accounting expenses. This can be particularly beneficial for smaller businesses that may lack the resources for detailed record-keeping and regular reporting.

Register C-Corp in the USA from Guyana:

1. Raising Capital: For businesses focused on attracting venture capital or aiming for a public offering in the future, C-Corps are typically the favored option by investors. They allow for the issuance of different stock types, which can appeal to investors looking for equity shares.

2. Desire for Structure: Some businesses may lean towards the formal structure of a C-Corp, which includes a board of directors and designated officer roles. This formal structure enhances credibility and sets up a clear hierarchy in bigger organizations.

3. Employee Benefits: C-Corps are beneficial for businesses planning to offer various benefits to a substantial workforce. They’re structured to efficiently manage such benefits, making them ideal for companies that wish to attract and retain highly skilled employees, including:

– Stock Options: C-Corps can provide employees the chance to purchase company stock at a predetermined rate, making them stakeholders in the company’s success.

– Tax Advantages: C-Corps enjoy certain tax benefits with employee benefits, such as deducting the cost of these benefits, which can be economically beneficial for both the company and its employees.

Overall, while LLCs might suit entrepreneurs from Guyana for their taxation, ownership, and compliance features, C-Corps are advantageous for capital raising and organized growth. The choice between an LLC and a C-Corp in the U.S. involves thorough contemplation.

Step 2: Pick a Name and a Corporate Ending

1. Choose a unique business name: Your business name must be unique within the state of incorporation. Check its availability on the respective state’s Secretary of State website.

2. Check for name availability: Ensure your registered agent, who must be located in the state of incorporation, verifies the name’s availability.

3. Consider the type of business entity: The business entity type, such as C-Corporation, LLC, or S-Corporation, has implications on your business name. For example, certain entities like S-Corporations have ownership restrictions impacting name choices.

4. Comply with state regulations: Comply with the specific business name regulations of your incorporation state. This includes adherence to processes such as reservations, filings, and other state-mandated procedures.

Step 3: Select Your Registration State

| State | Advantages | Disadvantages |

|---|---|---|

| Delaware | Favorable Tax Environment | Franchise tax may lead to slightly higher costs for businesses |

| No state corporate income tax for out-of-state business | ||

| No State Sales Tax | ||

| Ease of Business Formation | ||

| Flexible Business Structures | ||

| Wyoming | No corporate or personal income tax | Less recognized compared to other states |

| Cheaper franchise taxes | ||

| Nevada | No state corporate income tax | Higher annual reporting fees |

| Mandatory state tax return filing | ||

| Public listing of all officers and directors |

Step 4: Choose A Registered Agent For Legal Compliance

Key Aspects to Bear in Mind:

1. Physical Address: The agent should possess a real street address in your business’s registration state, not just a P.O. box.

2. Availability: They need to be accessible during usual business hours for document reception.

3. Compliance Expertise: Choose an agent who is an expert in your state’s specific business rules and regulations.

4. National Presence: For a business operating or planning to operate in various states, a registered agent with a nationwide service is beneficial.

5. Reputation: Opt for an agent with a strong reputation for reliability and efficiency.

6. Additional Services: Some agents might also offer support with business formation and necessary document submissions.

7. Fees: It’s important to understand the agent’s fee structure, ensuring it is flat and free from undisclosed charges.

Step 5: Provide details for the Owner, Director, and Manager (Who May Be A Single Individual)

– A passport

– Address

Step 6: Get A US Office (Virtual Or ExecutiveCenter)

When registering a company in the USA from Guyana, you have the option to obtain a virtual office, which can provide a professional business address and other services.

Want Help Setting Up Your Serviced Office?

With our registered agent services, we also offer serviced offices.

Step 7: Get an EIN From the IRS

For acquiring an EIN for your company from outside the US, there are two main approaches:

1. Apply for an EIN: You can apply for an EIN from the IRS after your company is incorporated. This unique identifier is vital for tax-related and other business matters.

2. Use a Registered Agent: Some registered agents can help obtain an EIN as part of the company registration process. These agents are responsible for handling legal and official documents and can sometimes streamline the EIN application.

Following the acquisition of your EIN, the next essential step is registering your company with FinCEN BOI in compliance with the latest regulations.

Register the company and beneficial owners with FinCEN BOI

Key Steps for FinCEN BOI Compliance:

Reporting Deadlines and Requirements

– Existing companies have one year to file, while new ones must do so within 90 days of creation or registration.

– Companies must provide four pieces of information about each beneficial owner: name, birthdate, address, and passport number.

Reporting Process and Frequency

– Reporting is not an annual task; you only need to submit a report once, unless you need to update or correct information.

– FinCEN started accepting reports on January 1, 2024.

Compliance and Fraud Protection

Step 8: Open a US Bank Account Remotely

Documents needed for opening a US bank account:

| Required documents | Description |

|---|---|

| Director’s Identification | Valid photo ID, such as a passport and driver’s license, or tax card with a photo. |

| Director’s Address Proof | Proof of the director’s residential address, e.g., utility bills or bank statements. |

| Incorporation/Organization Papers | Articles detailing the company’s structure, management, and membership. |

| EIN Confirmation | Verification letter issued by the Internal Revenue Service (IRS) for taxation purposes. |

| Business Location Verification | Evidence confirming that the business address is located in the United States. |

| Company Documents | May include the company’s certificate of incorporation, articles of organization, or other relevant documents. |

Step 9: Open A Merchant Account To Accept Credit Cards

Requirements for opening a Merchant Account:

– Business and personal credit history

– Certificate of incorporation

– Articles/memorandum of association

– Shareholder registry

In addition to business details, you might be required to provide personal information about yourself as a business owner. This includes:

– Your full name

– Your residential address

– Your ITIN (optional)

This is necessary because the merchant account provider conducts a credit check as a standard component of the underwriting process. Not all providers require a credit check anymore.

Step 10: Transfer Profits Home Or To A Lower Tax Jurisdiction

Getting Your Money from Guyana:

2. Methods for Transferring Funds from Guyana: To transfer funds from Guyana, individuals can utilize licensed money transfer agencies that comply with the country’s regulatory framework. These agencies facilitate the secure and legal transfer of funds domestically and internationally, adhering to the Anti-Money Laundering and Countering the Financing of Terrorism Act to ensure the legitimacy of financial transactions.

3. Taxation: Regarding tax implications, when receiving money from Guyana, individuals should consider any applicable taxes on the received funds.

Transferring Profits to a Lower Tax Jurisdiction

2. Insights into US Tax Policies: Comprehend the incentives provided by the US tax system for moving profits offshore to low-tax jurisdictions, keeping in mind the broader landscape of international tax laws and agreements.

Limitations and Regulations

2. Tax Implications: The U.S. requires reporting of international transfers exceeding USD 10,000 to the Internal Revenue Service.

Setting Up Transfers

Step 11: Get an ITIN from IRS for Banking and Credit (optional step)

Nevertheless, it’s crucial to remember that having an ITIN is not a requirement for initiating a business in the U.S.

What are the Costs and Registration Fees for Incorporating a Company in the USA?

Here’s a breakdown of the different taxes imposed by the top 5 states:

| State | Cost to Incorporate | Annual Franchise Tax |

|---|---|---|

| Delaware | $90 | $225 |

| Wyoming | $100 | $60 |

| New Mexico | $50 | $0 |

| Nevada | $75 | $0 |

| California | $70 | $800 |

Requirements to Register a Company in the USA for Guyanese Citizens

– Directors must be at least 18 years old (or have a parent representative) and have valid passports.

Frequently Asked Questions

Do I need to travel to the US for Company Registration?

What is a Certificate of Authentication and when is it required?

How can I obtain an Apostille for my US documents?

This process becomes invaluable when you’re looking to set up a bank account in Guyana or provide evidence of your U.S. company.

What should I do to authenticate Guyanese documents for use in the United States?

After this, your documents need to be legalized by the Guyanese Ministry of Foreign Affairs. Once these steps are complete, your documents will be legally recognized in the United States.

Is the Certificate of Authentication always necessary?

Final Steps to U.S. Business Success for Guyanese Entrepreneurs

Guyanese entrepreneurs can successfully traverse this route with strategic planning and the help of a reliable registered agent, who will assist with the legal aspects and the process of state registration.

We at Valis are ready to help. Contact us for a free, no-commitment consultation to discuss any questions you have about the information provided and to learn how you can get registered in just a few days.