This guide is your personalized roadmap, designed especially for Costa Rican entrepreneurs looking to learn how to register and start a company in the USA from Costa Rica. Together we’ll navigate through the complexities of the legal, financial, and operational aspects, paving the way for your success.

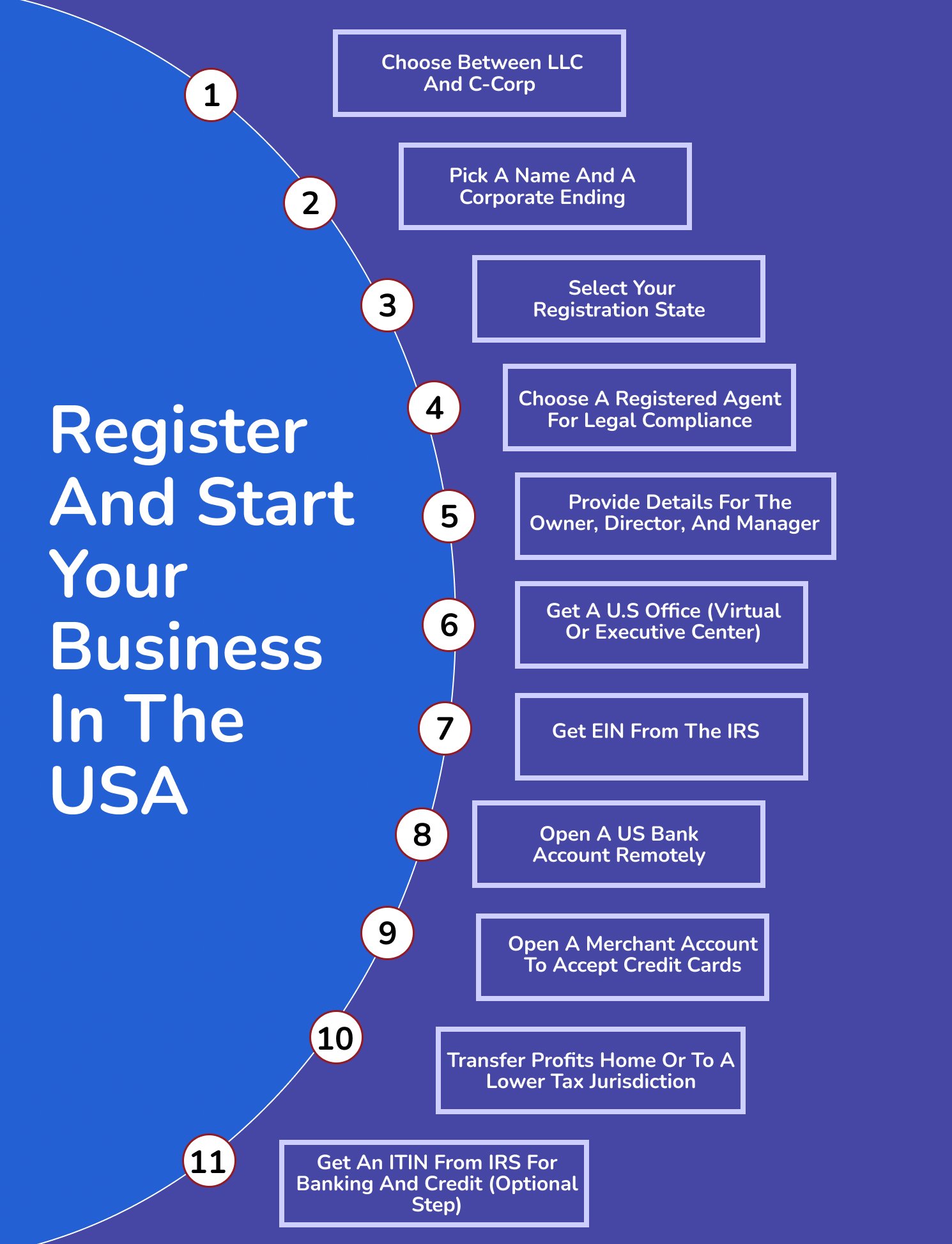

Register and Start your business in the USA

Step 1: Choose between LLC and C-Corp

Register LLC in the USA from Costa Rica:

2. Ownership: There are no restrictions on ownership in an LLC. Members can be non-US citizens, non-resident aliens, or domestic or foreign companies, making it a flexible option for foreign individuals or entities from Costa Rica.

3. Management: LLCs offer a flexible management structure, allowing owners to define their roles and operations without the need for formal structures. An LLC is designed to be a limited liability Sole Proprietorship (one owner) or Partnership (multiple owners) and is managed/owned with that in mind. This flexibility means less complexity and more direct control over business operations.

4. Compliance: With generally fewer compliance requirements and formalities, LLCs can lead to reduced legal and accounting costs. This is particularly advantageous for smaller businesses that may not have the resources for extensive record-keeping and frequent reporting.

Register C-Corp in the USA from Costa Rica:

1. Raising Capital: If the primary goal is to attract venture capital or go public in the future, C-Corp is typically preferred by investors. They allow for issuing various types of stocks, which can be enticing to investors looking for equity positions.

2. Desire for Structure: Some businesses may prefer the formal structure of a C-Corp, which includes a board of directors and defined officer roles. This can enhance credibility and establish a clear hierarchy within larger organizations.

3. Employee Benefits: C-Corps are favorable for businesses planning to offer a variety of benefits to a large workforce. They’re structured to easily handle such offerings, making them suitable for companies looking to attract and retain talented and skilled employees, such as:

– Stock Options: C-Corps can give employees the option to buy company stock at a specific price, making them part of the company’s growth and success. This is particularly appealing in startup or rapidly growing environments.

– Tax Advantages: C-Corps can enjoy certain tax advantages with employee benefits, like being able to deduct the cost of these benefits. This can be financially beneficial for both the company and its workforce.

In summary, while LLCs often suit foreign entrepreneurs from Costa Rica with their tax, ownership, and compliance benefits, C-Corps are valuable for fundraising and structured growth. Deciding between an LLC and a C-Corp in the U.S. requires careful consideration.

Step 2: Pick a Name and a Corporate Ending

1. Choose a unique business name: The name should be unique and not already in use in the state where you plan to register your company. You can check the availability of the name on the state’s Secretary of State website.

2. Check for name availability: The registered agent (who must have a physical address in the state where you plan to register your company) will verify that the name is available if you ask.

3. Consider the type of business entity: The type of business entity you choose, such as a C-Corporation, LLC, or S-Corporation, will also influence the name of the company. For example, an S-Corporation can only have U.S. residents as owners, so it isn’t suitable for foreign business owners.

4. Comply with state regulations: Each state has specific regulations regarding business names, and you must ensure that your chosen name complies with these requirements. This may include checking for reservations, filings, and other procedures as required by the state.

Step 3: Select Your Registration State

| State | Advantages | Disadvantages |

|---|---|---|

| Delaware | Favorable Tax Environment | Franchise tax may lead to slightly higher costs for businesses |

| No state corporate income tax for out-of-state business | ||

| No State Sales Tax | ||

| Ease of Business Formation | ||

| Flexible Business Structures | ||

| Wyoming | No corporate or personal income tax | Less recognized compared to other states |

| Cheaper franchise taxes | ||

| Nevada | No state corporate income tax | Higher annual reporting fees |

| Mandatory state tax return filing | ||

| Public listing of all officers and directors |

Step 4: Choose A Registered Agent For Legal Compliance

Here are some key considerations when choosing a registered agent:

1. Physical Address: The registered agent must have a physical street address within the state where the business is registered. A P.O. box is not acceptable.

2. Availability: The registered agent must be available during normal business hours to receive legal and official documents.

3. Compliance Expertise: The registered agent should be an expert in the state’s business compliance rules and regulations.

4. National Presence: If the business operates in multiple states or plans to expand into other states, having a national registered agent service is a great option.

5. Reputation: Choose a reputable registered agent with a track record of providing reliable and efficient services.

6. Additional Services: Some registered agents may offer additional services, such as assistance with business formation and filing required formation documents.

7. Fees: Consider the fees charged by the registered agent and ensure that they offer a flat-fee model without any hidden charges.

Step 5: Provide details for the Owner, Director, and Manager (Who May Be A Single Individual)

– A passport

– Address

Step 6: Get A US Office (Virtual Or ExecutiveCenter)

For entrepreneurs from Costa Rica registering a business in the USA, a virtual office is an excellent option. It not only provides a reputable business address but also includes various additional services.

Looking for Support in Setting Up Your Serviced Office?

We complement our registered agent services with offerings of serviced offices, catering specifically to the needs of various businesses.

Step 7: Get an EIN From the IRS

To secure an EIN outside the US for your company, there are two main methods available

1. Apply for an EIN: After incorporating your company, you can apply for an EIN from the Internal Revenue Service (IRS). An EIN is a unique nine-digit number assigned by the IRS to identify your business for tax purposes.

2. Use a Registered Agent: When registering your company, some registered agents can assist in the process of obtaining an EIN. The registered agent is responsible for receiving legal and official documents on behalf of the business, and they can also sometimes help with the EIN application process.

Once you’ve successfully applied for your EIN, the next crucial step is to register your company with FinCEN BOI in accordance with the latest legislation and regulations.

Register the company and beneficial owners with FinCEN BOI

Here are the key points for registering your company and beneficial owners with FinCEN BOI:

Reporting Deadlines and Requirements

– Existing companies have a one-year period to comply with this filing, while new companies need to file within 90 days of their establishment or registration.

– The report must include four specific pieces of information for every beneficial owner: their name, birthdate, address, and passport number.

Reporting Process and Frequency

– Reporting to FinCEN is a one-time requirement, not an annual one. Additional submissions are only needed if updates or corrections are required.

– FinCEN began receiving BOI reports from January 1, 2024, onwards.

Compliance and Fraud Protection

Step 8: Open a US Bank Account Remotely

Documents needed for opening a US bank account:

| Required documents | Description |

|---|---|

| Director’s Identification | Valid photo ID, such as a passport and driver’s license, or tax card with a photo. |

| Director’s Address Proof | Proof of the director’s residential address, e.g., utility bills or bank statements. |

| Incorporation/Organization Papers | Articles detailing the company’s structure, management, and membership. |

| EIN Confirmation | Verification letter issued by the Internal Revenue Service (IRS) for taxation purposes. |

| Business Location Verification | Evidence confirming that the business address is located in the United States. |

| Company Documents | May include the company’s certificate of incorporation, articles of organization, or other relevant documents. |

Step 9: Open A Merchant Account To Accept Credit Cards

Requirements for opening a Merchant Account:

– Providing a record of your business and individual credit histories.

– Including a copy of your Certificate of Incorporation.

– Adding your Articles or Memorandum of Association.

– Listing information in the Shareholder registry.

Additionally, as a business owner, you may need to supply personal details such as:

– Your full legal name.

– Your current residential address.

– Optionally, your ITIN.

This information is important for the credit check process, which is a usual part of most merchant account providers’ underwriting procedures, though not universally required anymore.

Step 10: Transfer Profits Home Or To A Lower Tax Jurisdiction

Getting Your Money from Costa Rica:

2. Methods for Transferring Funds from Costa Rica: Transferring funds from Costa Rica can be done through banks, wire transfer services, or online payment platforms.

3. Taxation: The tax implications of getting your money from Costa Rica depend on various factors including the source of income and residency status. Generally, income earned in Costa Rica may be subject to taxation under local tax laws.

Transferring Profits to a Lower Tax Jurisdiction

2. US Tax System: Understand how the US tax system may incentivize offshoring profits to low-tax jurisdictions within the context of international tax laws and agreements.

Limitations and Regulations

2. Tax Implications: When sending money from Costa Rica to the U.S., there are usually no taxes imposed on the transfer itself. However, if the sender is a U.S. taxpayer, they might need to report the transaction on their tax return, especially if it involves a significant amount.

Setting Up Transfers

Step 11: Get an ITIN from IRS for Banking and Credit (optional step)

When registering a U.S. company from Costa Rica, getting an Individual Taxpayer Identification Number (ITIN) from the IRS can help with smoother banking and building a credit history for you and the business.

However, it’s important to know that you don’t need an ITIN to start a business in the U.S.

What are the Costs and Registration Fees for Incorporating a Company in the USA?

Here is an overview of the different tax structures in the top 5 states preferred for incorporation:

| State | Cost to Incorporate | Annual Franchise Tax |

|---|---|---|

| Delaware | $90 | $225 |

| Wyoming | $100 | $60 |

| New Mexico | $50 | $0 |

| Nevada | $75 | $0 |

| California | $70 | $800 |

Requirements to Register a Company in the USA for Costa Rican Citizens

– Ensure that all directors are at least 18 years of age (or are represented by a legal guardian) and hold valid passports.

Frequently Asked Questions

Do I need to travel to the US for Company Registration?

What is a Certificate of Authentication and when is it required?

How can I obtain an Apostille for my US documents?

This step becomes vital, particularly if you’re planning to open a bank account in Costa Rica or provide paperwork for your U.S. company.

What should I do to authenticate Costa Rican documents for use in the United States?

Since Costa Rica is part of the Hague Convention, no diplomatic authentication or consular legalization is necessary.

Is the Certificate of Authentication always necessary?

Final Steps to U.S. Business Success for Costa Rican Entrepreneurs

As an Costa Rican entrepreneur, you can navigate this process with strategic planning and the right registered agent at your side, to help you through the legal steps and the state registration process.

Feel free to reach out to us for a free, no-obligation consultation where we can answer any questions regarding the information above and how you can get registered in just a matter of days.